EasyVest Automated Digital Advisor and EasyVest YourChoice:

Effortless Investing

for Your Future

All in One User-Friendly Platform

Choose the Best Path for Your Future

Automated Digital Advisor or

YourChoice

Investing, Simplified

EasyVest Investment Options:

EasyVest Automated Digital Advisor

All in One User-Friendly Platform

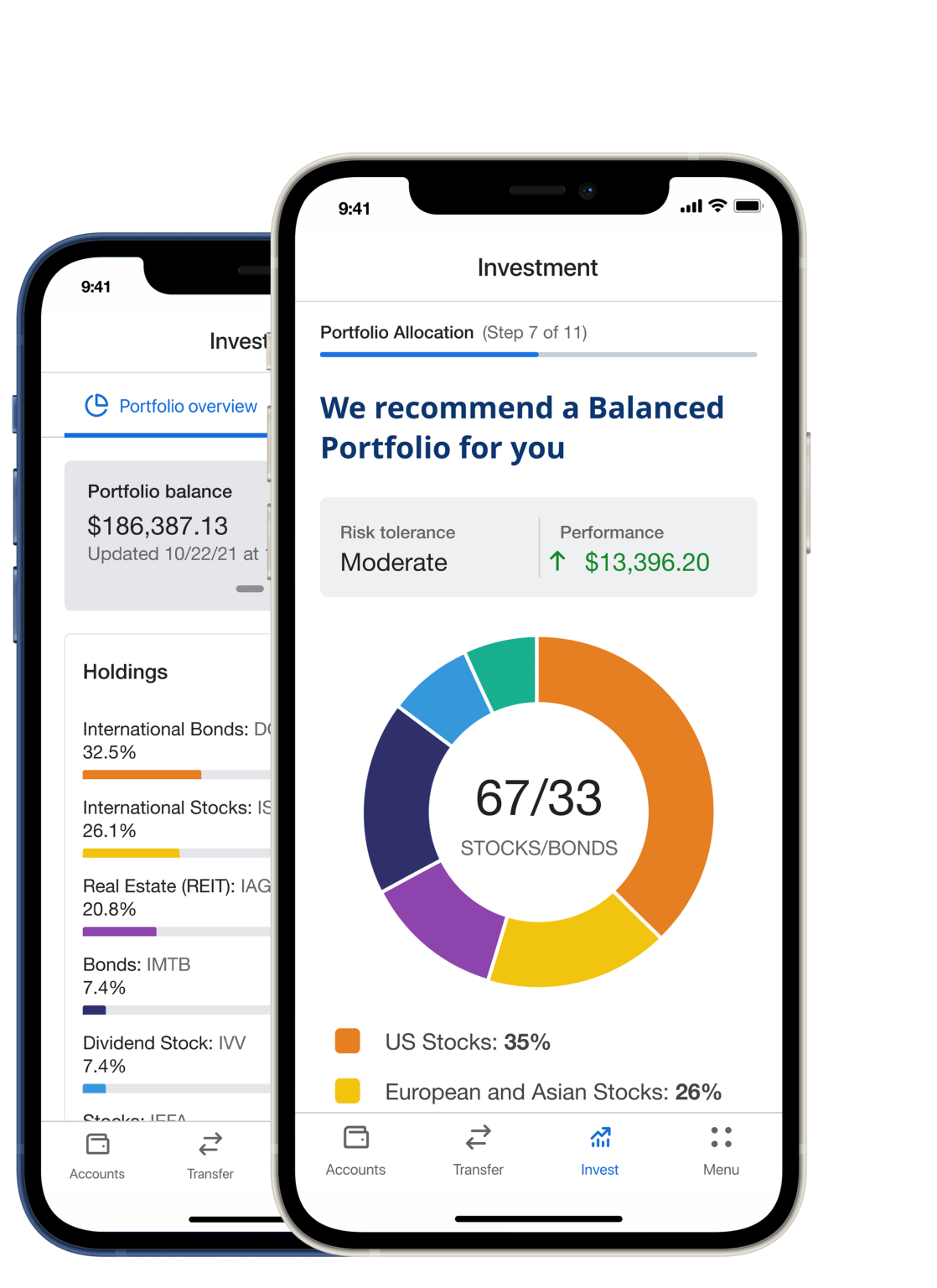

Start with just $200. Let EasyVest’s automated advisor create a personalized investment strategy for you, analyzing live market data to optimize your portfolio automatically.

- Personalized Portfolio Strategy: Answer a few questions, and EasyVest instantly builds a diversified portfolio tailored to your goals.

- Effortless Automated Investing: EasyVest constantly monitors and adjusts your portfolio, keeping it aligned with your financial objectives.

- Start with Just $200: Add funds at any time, or set up recurring transfers from your JetStream FCU account.

- Low-cost Exchange Traded Funds (ETFs)

- Easily move securities from your other brokerage accounts into EasyVest

EasyVest YourChoice:

- Low Initial Investment: Begin with a $1,000 minimum.

- Real-Time Stock Trading: Buy, sell, or trade up to 500 shares each month.

- Fractional Share Investments: Invest any amount, even in high-value stocks.

- Enjoy up to 500 shares or 50 trades per month without commissions.

(A $0.01 fee per share and a $0.05 minimum apply beyond this limit.) - Account types include: Individual, IRAs (Traditional or Roth), Joint, or Custodial

- Over 6,000 individual stocks and Exchange-Traded Funds (ETFs) to choose from

- Easily move securities from your other brokerage accounts into EasyVest

- Add funds at any time or set up recurring transfers from your JetStream FCU checking account.

Choose the stocks you want to buy, sell, and the amount you invest.

Enjoy the freedom and flexibility to shape your financial future with EasyVest YourChoice.

Invest Smartly:

Knowledge is Power

Here are some popular resources where you can learn about investments and strategies:

- Morningstar: Investment Classroom

- Yahoo Finance: Investments

- Google Finance: Financial Insights

- Securities and Exchange Commission: Guide to Savings and Investing

JetStream FCU does not endorse these resources and recommends consulting a financial advisor for personalized guidance. Remember, smart investing begins with knowledge and research.

Comparison Chart

Feature

- Minimum Investment

- Management Style

- Stock Trading

- Monthly Fee

- Best For

Automated Advisor

- $200

- Automatic

- Not Applicable

- None

- Hands-off investors

YourChoice

- $1,000

- Self-directed

- Up to 500 shares/month

- $2.50

- Active investors who want control

Minimum Investment

Automated Advisor: $200

YourChoice: $1,000

Management Style

Automated Advisor: Automatic

YourChoice: Self-directed

Stock Trading

Automated Advisor: Not Applicable

YourChoice: Up to 500 shares/month

Monthly Fee

Automated Advisor: None

YourChoice: $3 (waived for Signature Members)

Best For

Automated Advisor: Hands-off investors

YourChoice: Active investors who want control

Investing made

simple and accessible

Designed to make investing simple and accessible for anyone who is interested in building wealth but unsure how to get started.

Types of accounts:

- Individual

- Joint

- Custodial

- IRA Traditional

- Roth Investment

How to...

Frequently Asked Questions

-

Account Management

Is there an account minimum?The minimum initial deposit required to open an investment account is $200. After your account is open, the minimum required balance is $200.How do I open an EasyVest account?- Sign in to JetStream FCU’s online banking or mobile app, navigate to EasyVest, and select Get Started where you’ll be prompted to Open EasyVest Automated Account.

- Answer a short series of guided questions to help us understand your investment experience, risk tolerance, time horizon, and financial goals.

- Next, EasyVest instantly builds your custom diversified portfolio strategy. You can confirm your portfolio goals and review the recommended investments, or review and change your answers to adjust your portfolio strategy.

- Fund your new investment account by transferring funds from your JetStream FCU checking account. Reminder: It may take 3-5 business days for us to set up your investment portfolio and for you to see trades in your investment account.

Are there fees for using EasyVest automated investing?Upon opening your EasyVest automated investment account, you will be presented with the fee schedule. There is an account management/advisory fee of 0.5% per year of the value of your EasyVest account, or 0.042% per month, subject to a minimum fee of $0.50 per month. This fee is charged to your EasyVest account on the first day of each calendar month. Other service fees may apply based on your account registration and activity.

What kind of account will I be opening?You will be opening an EasyVest investment account that invests in securities. Your EasyVest account is not a JetStream Federal Credit Union account or share. The investment account is held at Drivewealth, LLC, a securities brokerage firm, that is not affiliated with the Credit Union. The account is managed by Access Softek Advisory Services, LLC, which is not affiliated with the Credit Union. Your EasyVest automated advisor account is NOT intended to be used as an actively traded brokerage account. It is solely designed to provide a tailored portfolio to meet your stated risk tolerance, investment objective and time horizon.

Can my investment account lose money?Yes. It’s important to understand that all investment involves risk of loss. Your account, like all investment accounts, will be subject to the risk of loss, including the loss of your invested principal, if the market value of the investments in your account declines. We automatically re-balance your portfolio monthly to maintain the level of risk that you specified for your investment goals. Depending on the level of risk you specified, your account may have a higher or lower level of risk.Is my money secure?DriveWealth LLC, which provides brokerage services through EasyVest to JetStream FCU members, is an SEC-registered broker-dealer and member of FINRA/SIPC. A regulator for all securities firms doing business in the United States.Is my investment account protected by insurance?Your investment account is not insured by the NCUA, FDIC, or any other insurance that protects against investment losses. Accounts at Drivewealth are insured by the Securities Investor Protection Corporation https://www.sipc.org, which protects investment accounts if DriveWealth becomes financially troubled. SIPC insurance does not protect you against declines in the value of your securities.How can I close my EasyVest account?If you want to close your EasyVest account, sign in to your EasyVest account, select Settings, and select Close account. You will be charged any remaining fees if your account is closed before the billing cycle ends. All recurring and/or scheduled deposits and withdrawals will be cancelled. Processing may be delayed by up to one full business day to accommodate possible incoming ACH transfers. The final balance from your closed account will be transferred by ACH deposit into your JetStream FCU checking account, which may take up to 3-5 business. You may not close your account until it has been open for at least 30 days.What is an automated digital advisor and how will it help me?Our EasyVest automated investment management advisor uses a data-driven algorithm to determine what securities to buy for your account and how much of each security to purchase for your account. In order to make that determination, we gather information from you about you and your investment goals. We use that information to design a portfolio that is recommended for an investor with your objectives, timeline and risk tolerance.

The securities in your account will be “exchange traded funds” (ETFs) selected from a list of ETFs Access Softek Advisory Services has identified. ETFs are regularly evaluated to determine which ETFs work best for our EasyVest account holders, so this list may change from time to time. Each ETF is a diversified investment that may hold a variety of stocks and/or debt securities, depending on the stated strategy of the particular ETF. Your portfolio will also include some cash. More information about the ETFs in which your account may be invested and their strategies and investment categories are available from the EasyVest Investment Chat feature.

What does it mean for my account to be rebalanced, and how often will that happen?Because some ETFs’ market values may increase or decrease more than those of other ETFs, the proportions of the various securities in your account will change over time. The EasyVest algorithm will automatically rebalance your portfolio quarterly to ensure that the proportions of the ETFs in your account are still consistent with the investment goals you provided. EasyVest will also rebalance your portfolio on withdrawals and additional contributions to your investment account.

-

Managing Your Portfolios

Where can I find my investment portfolios?Sign in to your JetStream FCU online banking or mobile app. From online banking in the navigation bar, find the Accounts tab, and select EasyVest. From our mobile app, tap Menu from the bottom menu and select EasyVest. EasyVest will launch your Portfolio Overview, Transactions, eStatements, and Settings pages for you to track your investment account.Where can I check my portfolio performance?On your EasyVest Portfolio Overview page, you’ll find your Portfolio Balance, Portfolio Performance, Total Earnings, and Holdings Details. Please note that around 3% cash reserve is allocated in your portfolio for fee collection and general liquidity purposes. When your total gains are calculated, this 3% cash reserve is also included.Where can I find my monthly statements, trade confirmations and tax documents for my investment account?All documents are available online, go to the EasyVest eStatements page where you can view and download these forms.Where can I find my investment account number?From the EasyVest Settings page, click the Show My Account Number button.What investment portfolios does Access Softek Advisory Services, LLC provide?They offer a variety of different portfolios composed of lower-cost, broad index, passive Exchange Traded Funds. They currently use BlackRock iShares passive ETFs. Portfolios contain between 4 and 10 broadly diversified Index ETFs. Your portfolio is diversified to reflect your individual time horizon, risk tolerance and investment objectives. The longer your time horizon and the greater your risk tolerance, the more likely your portfolio will contain a broader selection of domestic and international stock and bond ETFs.Can I switch my investment portfolio strategy?You can switch your portfolio by updating your EasyVest profile. Located under the Settings page, click Update preferences to update your preferred risk tolerance and time horizon. EasyVest automated digital advisor will instantly provide a new portfolio strategy suggestion.How many investment accounts can I own?You can open as many EasyVest investment accounts with us as you like. This means you could save for a down payment, your child’s education, and your retirement all at the same time.Can I open a joint investment account?Yes, when you start the EasyVest investment account opening process simply select Joint account and enter the email address for the Joint. EasyVest will send out an email invite to the Joint user. After the application is complete you will both enjoy joint access to this investment account.Can I open a company, partnership or LLC investment account?As of December, 2021, Company, partnership and LLC accounts are not available. We value your feedback and may be able to offer this in the future based on our customers’ needs.Can I open a Custodial account?Yes, when you start the EasyVest investment account opening process select Custodial account. You will need the complete personal information for the minor. Opening a custodial account is a great way to make a financial gift to a minor and help them learn about investing. For a deeper look into the benefits of a custodial account, click here.

-

Transfers and Withdrawals

Can I make a recurring transfer into my EasyVest investment account?Yes, you can set up an automatically recurring transfer from your JetStream FCU checking account. Our maximum recurring transfer amount is $5,000.00. Funding frequency options for recurring transfers are:

- Daily (every business day)

- Every other Monday

- 1st of each month

- 15th of every month

- Every 3 months on the 1st

Can I withdraw or transfer funds from my EasyVest account?Yes. Beginning 30 days after you open your account, you may withdraw some or all of your account at any time. For example, if you deposit $500 on 7/1 and $800 on 8/1, you would be able to withdraw $500 on 7/31 and $ 800 on 8/31.Are there any dollar limits or fees if I transfer funds out of my account?We charge $0.25 for each withdrawal and there are no limits on the number of times you can withdraw. There is an ACH transfer limit of $110,000 per transfer.How can I withdraw from my EasyVest investment account?From your EasyVest account, navigate to the Transfers & History tab, select Create new transfer, and complete the required fields. It can take 3-5 business days for the transactions to be fully processed due to the time required to buy/sell the securities and move the money to or from your checking/savings account, which happens via ACH transfer.

Your EasyVest account is typically required to sell securities to fund a withdrawal. A sale of securities will likely result in taxable gain or loss for you. You should consult with your own tax advisor before deciding to withdraw funds from your account.

If you make withdrawals from your EasyVest automated advisor investment account before the estimated time horizon you provided when opening your account, your account may not perform as intended. An early withdrawal may result in a loss of principal or subpar performance. The larger the time differential from your stated time horizon, the greater the likelihood of loss or underperformance might be.

Are there any limits on when I can withdraw from my EasyVest investment account?All deposits into your EasyVest investment account have a 30 day hold to comply with anti-money laundering regulations. After this 30 day hold expires, you may withdraw some or all of your funds at any time. It can take 3-5 business days for the funds to appear back in your JetStream FCU checking account.Can I transfer investments from my individual investment account located at a different brokerage firm?Yes, if the brokerage firm utilizes ACATS. ACATS method (Automated Customer Account Transfer Service), which automates transfers of assets and cash between brokerage firms. Generally, an ACATS transfer is faster and more convenient than other types of transfers. All the assets will be transferred in kind, liquidated once received and reinvested into target portfolio.How does ACATS (Automated Customer Account Transfer Service work)?All of the assets will be transferred in kind, liquidated once received and reinvested into a target portfolio. Thus, there could be tax consequences for this action. Please note that if you transfer assets that our broker does not support, your transfer will fail. To request a list of supported instruments, please emailThis email address is being protected from spambots. You need JavaScript enabled to view it. . If your instrument is supported, once you submit your transfer request, it may take up to 2-3 weeks before it gets fulfilled. To help us start working on your request, please provide your institution DTC number and carrying account number.How can I start an ACATS request (Automated Customer Account Transfer Service)?From your EasyVest account, select Asset Transfer to get started. Click “I would like to transfer my assets to EasyVest”, select the EasyVest portfolio you want to transfer into, and set up your transfer by providing your DTC number of the organization and source account number. We will ask you a few questions about your current firm, so it helps to have a statement handy. -

Investment Terminology

Investment goalWhat does capital preservation mean?

The investor wants to preserve or protect your capital or principal. In other words, maintain the value of the original investment as much as possible while providing a reasonable return.

What does income mean?

The investor wants to receive regular income from the investment, like dividends or interest payments.

What does growth/income mean?

The investor wants investments that can both grow in value and provide income.

What does growth mean?

The investor’s primary objective is to grow the investment, with regular income payments being less important.

What is rebalancing?

Rebalancing means buy and sell securities for your account to return to the originally recommended ETF percentage allocations for your portfolio, within a designated tolerance.

What is a prospectus?A prospectus is a legal disclosure document that describes a stock, bond, mutual fund or other security for investors. Prospectuses are created by security issuers.

What is an ETF?An exchange-traded fund (ETF) is an investment fund that is traded on stock exchanges throughout the trading day, much like stocks and unlike mutual funds. An ETF holds assets such as stocks, commodities, or bonds, and trades close to its net asset value over the course of the trading day. Most ETFs track an established index, the S&P 500 being a common example. We have and will continue to evaluate the ETF landscape with a focus on providing lower-cost, client-appropriate investments to assist our clients in meeting their needs. -

Guidance for answering our investment questions

When do you plan to withdraw your investment?Let us know how long you plan to invest your money. For example, if you’re saving for your child’s education, how long will it be until you want to start withdrawing the funds for that expense?What is your investment experience?None = I’m new to the idea of investing.

Limited = I have some investment experience, but I have not made many investments. I understand some aspects of investment markets and risks, but I do not consider myself an investor.

Good = I have made several investment decisions on my own or with the assistance of a professional. I have seen the value of my investments fluctuate both up and down, and I have a good understanding of markets and general risk characteristics.

Extensive = I have invested money numerous times in a variety of investment types, with or without professional assistance. I know how much risk I can take, and I understand the fluctuating nature of investments and securities in general.

What is your annual income?Estimate your expected annual income, before taxes, taking into account all your sources of income. You will have an opportunity to update this number at least annually.

For this investment, I prefer...Option 1 Lower gains and lower losses preferred.

You prefer a conservative approach with little risk tolerance. Your primary focus is on limiting your losses, and you understand that this choice will also limit your growth opportunities. The portfolios selected for your account will include fewer options than more aggressive portfolios and will primarily focus on ETFs that hold debt securities.

Option 2 Low to moderate gains and losses preferred.

You are a conservative investor, with moderate risk tolerance. You want to include some growth opportunities, as long as losses are still somewhat limited. Your portfolio will include additional investment options that may fluctuate with market gains and losses.

Option 3 Both moderate gains and losses.

You have a moderate risk tolerance, and you prefer investments with a moderate chance of gains or losses. The portfolios selected for you will include a wider range of investment options compared to more conservative portfolios.

Option 4 Moderate to higher gains and losses ok.

You are a moderately aggressive investor if you prefer exposure to investments that have higher possibility of gains, even if that also means a moderate to high risk of losses. These portfolios include additional investment options and higher percentage allocations to investments that are not included in more conservative to moderate portfolio models.

Option 5 High gains and losses.

You are an aggressive investor. You want to allow for both higher gains and losses. These portfolios include a higher percentage allocation to ETFs that have the potential to increase in value, but also a higher probability of losses.

What is your investment objective?Capital Preservation: Choosing this option suggests that you are a very conservative investor valuing protection of principal over income or growth of that principal.

Income: Choosing this option suggests that you are investing to receive monthly income to live on, and that you are willing to take some risk with your principal.

Growth/Income: Choosing this option suggests that you prefer both current income and future growth, and that you are willing to take risk on the return on principal.

Growth: Choosing this option suggests that your goal is simply to grow your money for future needs, even though that means taking on the risk of loss of principal.

-

Customer Support

How does Access Softek’s client support work?Inside the EasyVest product you will find a Chatbot that is available throughout the product, whether you have an investment account or not. The Chatbot can answer most investor questions and is frequently updated to support any new questions that it was previously unable to handle. In addition, Access Softek’s team of client service specialists are available via email in the event that you can’t find your answer in our chatbot. General requests are typically answered within one business day, but some requests require significant research that may delay our response to you.

How can I change my address and update contact info?Contact information for your investment account is automatically pulled from your online/mobile banking account. Any time you make an update to your email, phone, address, etc., inside digital banking, that information will automatically sync with your investment account the next time that you open the investment portal. If you ever have issues with you’re the contact information on your account, you are welcome to contact us at

This email address is being protected from spambots. You need JavaScript enabled to view it. .

Not NCUSIF insured. No Credit Union Guarantee. Not a deposit. May lose value. Not insured by any federal government agency. EasyVest is a micro-investing solution powered by Access Softek, Inc. Brokerage services are offered through DriveWealth LLC, a registered broker-dealer (member FINRA/SIPC). JetStream Federal Credit Union is not registered as a broker-dealer. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Access Softek’s internet-based services are designed to assist clients in achieving discrete financial goals. They are not intended to provide comprehensive tax advice or financial planning with respect to every aspect of a client’s financial situation and do not incorporate specific investments that clients hold elsewhere.