Digital Banking

Digital Banking Made Easy

Experience the convenience of managing your finances securely from anywhere, at any time.

Features Simplified

Seamlessly Connect, Manage, and Experience Benefits

DIGITAL BANKING

Frequently Asked Questions

When you enroll for online or mobile banking, the information you input must match the information we on file for you. For example, if a person has two last names on file with us, they must enter both names during enrollment.

To help us verify your identity during self-enrollment, our system will require a unique PIN which it will send the user either by SMS, voice call, or email.

No, you can enroll for digital banking right from our new app without the requirement to enroll in online banking.

Creating recurring alerts in the digital banking platform is simple! After logging in, navigate to the "Alerts" section, and from there, you can set up your preferred notifications with the desired frequency, amount thresholds, and account activities.

As much as we would love to transfer your existing app settings, unfortunately, they will not carry over to the new app. To make the most of the upgraded features and improvements, you'll need to download the new app and set up your preferences again. We apologize for any inconvenience this may cause and assure you that the process is quick and easy.

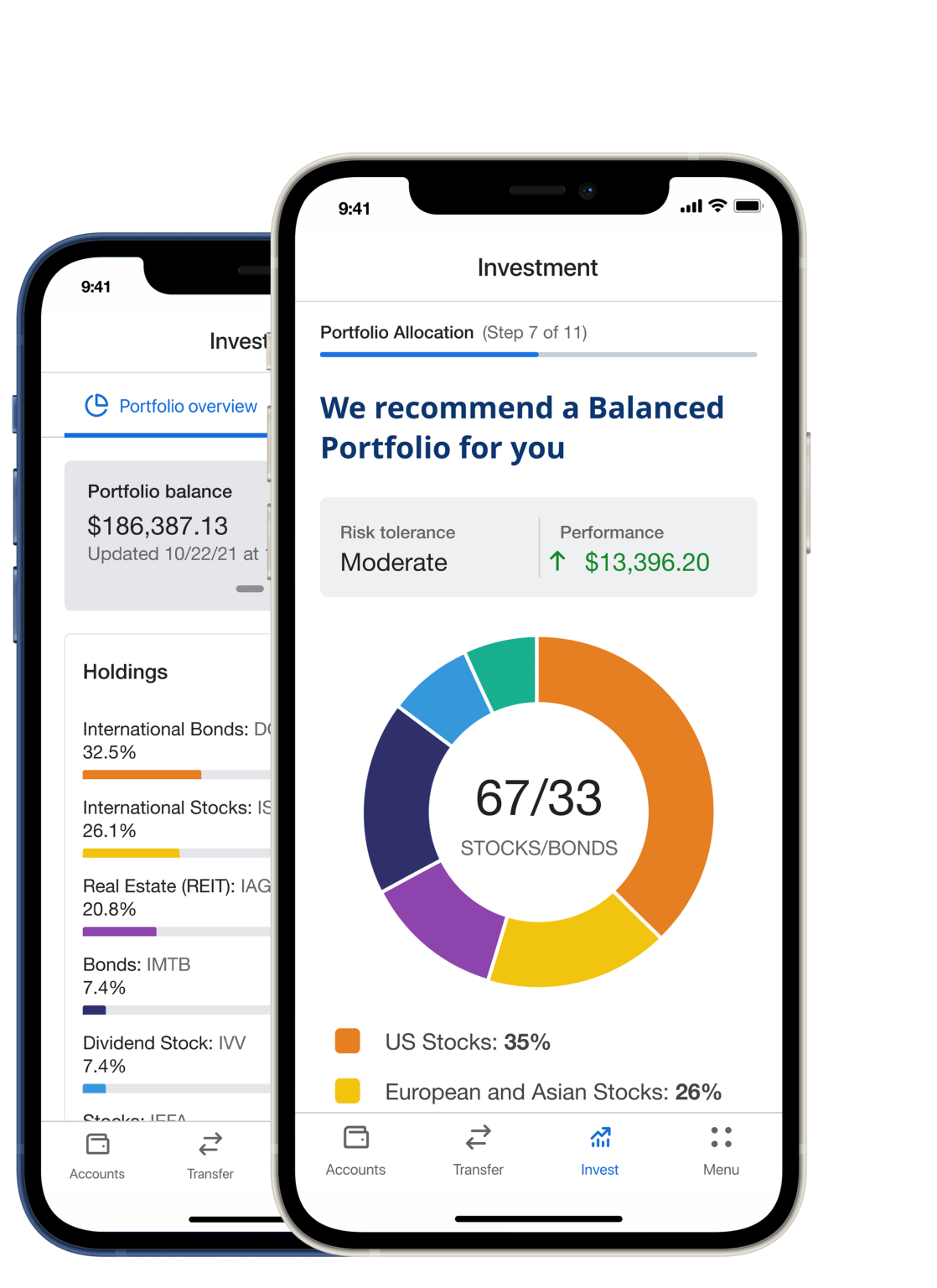

Discover EasyVest in Digital Banking:

Your Gateway to Streamlined Investments

Plaid Integration

What Does This Mean for You?

- Streamlined Loan Payments: Now you can easily make payments on your JetStream loans using funds from your accounts at other financial institutions.

- All Your Accounts in One Place: Whether it’s a checking, savings, or credit card account, see all your balances and transactions at a glance.

- Instant Verification: Link your external accounts in just a few steps—no waiting for days to confirm your information.

How to Get Started?

- Log In to your JetStream Online or Mobile Banking.

- Link Your Accounts using Plaid’s secure verification process.

- Start Managing & Making Payments from your linked accounts right away!

With this integration, you can better manage your money, track expenses, and plan for the future—all with one secure login.

Experience hassle-free banking today by linking your accounts through Plaid!